How many Sim Racers are there in 2024? It’s a question that’s been on the minds of many enthusiasts and industry insiders alike: just how many sim racers are there in 2024? As the popularity of racing simulators continues to surge, fueled by advances in technology and a growing global community, the curiosity about the size of this dedicated fanbase has never been greater. Let’s dive into the numbers and uncover the true scale of the sim racing world today.

What makes a Sim Racer?

What is a “sim racer” even? To make the definition simple, for our purposes we are going to call a sim racer anyone that plays simulator and simcade racing games on any software platform with a physical steering wheel and pedals setup. The reasoning is that anyone that commits to physical sim racing hardware peripherals can move into more hardcore simulation software as they go deeper in their sim racing journey. This analysis may overestimate the number of global players because it would count Gran Turismo and Forza players that play with physical sim racing hardware (but not the ones playing with handheld controllers).

The Pandemic Sim Racing Boom

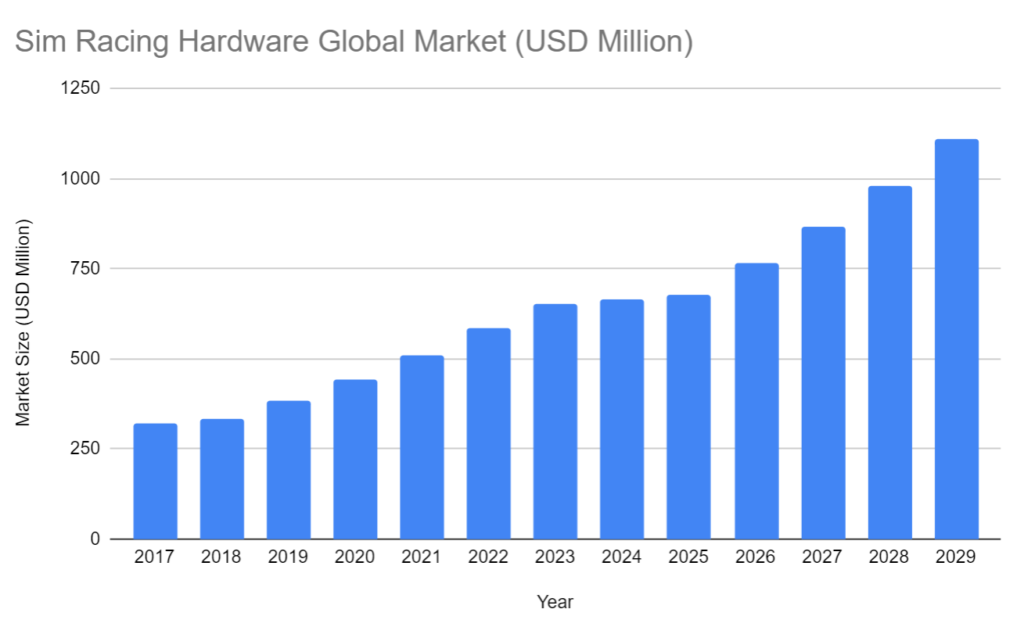

The racing simulator market is on fire. The recent sharp growth was ignited by the pandemic but sustainable tech advancements and the relentless pursuit of the ultimate immersive experience have continued in the years following. According to analysis by Pernas Research , Spherical Insights , GI Research and Markets & Markets, the global racing simulator market has been experiencing steady growth over the years. From an estimated USD 333.61 million in 2017 and is expected to reach USD 677.97 million in 2024. This upward trajectory reflects the growing popularity and demand for racing simulators across the globe. North America is leading the charge, with Europe and Asia-Pacific hot on its heels.

Methodology for calculating sim racing player base

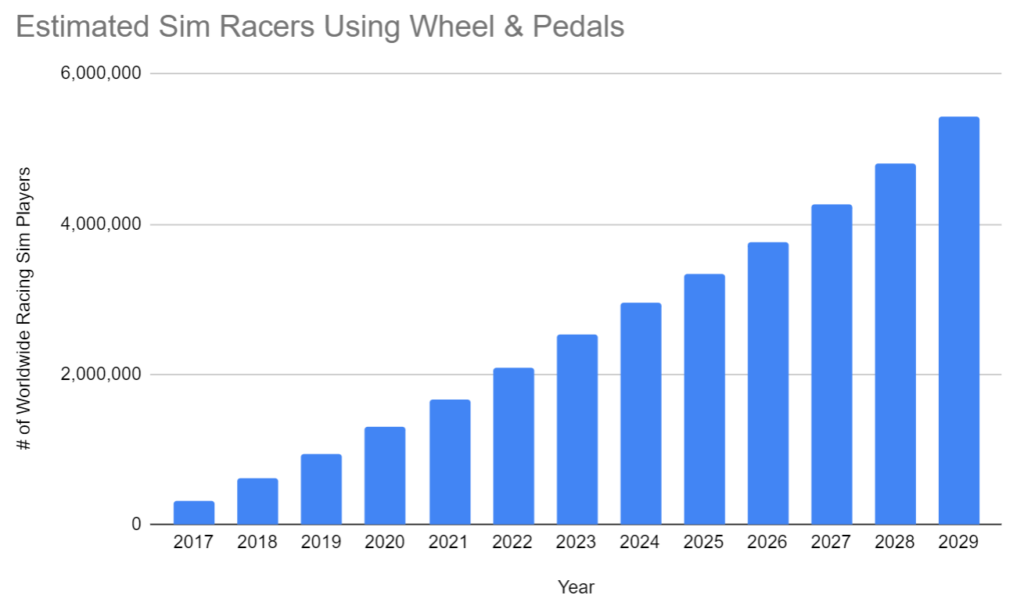

To accurately estimate the number of sim racers using steering wheels and pedals in 2024, we need to consider the cumulative sales of sim racing hardware over the past decade. By analyzing the market size data from 2017 to 2024, we can determine the total market value and estimate the number of players based on average spend per player on sim racing hardware.

Calculating Total Market Value:

Estimated revenue from sim racing hardware worldwide from 2017 to 2024:

- 2017: USD 333.61 million

- 2018: USD 383.92 million

- 2019: USD 441.8 million

- 2020: USD 508.41 million

- 2021: USD 585.05 million

- 2022: USD 653.18 million

- 2023: USD 665 million

- 2024: USD 677.97 million

Total market value from 2017 to 2024: USD 4.249 billion

Average Spending Per Player:

We assume an average sim hardware spend of USD $1,000 per player, (which includes the cost of steering wheels, pedals, and other sim racing equipment). These estimated number of players will change depending on how we estimate the average hardware spend per player. Compact simulator bundles are the entry-level rigs (bundles under USD 1,000), push the average spend down even though high end sims cost many multiples of that figure.

Estimating the Sim Racing Army

For each year, we calculated the number of new players by dividing the market size by the average spending per player and then adjusting for attrition (churn rate). We assume an annual attrition rate of 10%, meaning 90% of the previous year’s players remain active each year.

“According to our methodology, we estimate that approximately 2 to 2.5 million sim racers worldwide will be using steering wheels and pedal sets in 2024.”

Global Sim Racing Community in 2024

Based on our methodology above, we estimate that approximately 2.5 million sim racers worldwide will use steering wheels and pedal sets in 2024. This estimation reflects the diverse and dynamic nature of the sim racing community, encompassing enthusiasts of all backgrounds and experience levels. The vibrant and growing world of sim racing is here to stay, and 2024 promises even more thrilling developments and immersive experiences for racers everywhere. So, strap in, hit the track, and keep pushing the limits (but consider starting slowly at Monza Turn 1).

Sources: Pernas Research | Spherical Insights | GI Research | Markets & Markets